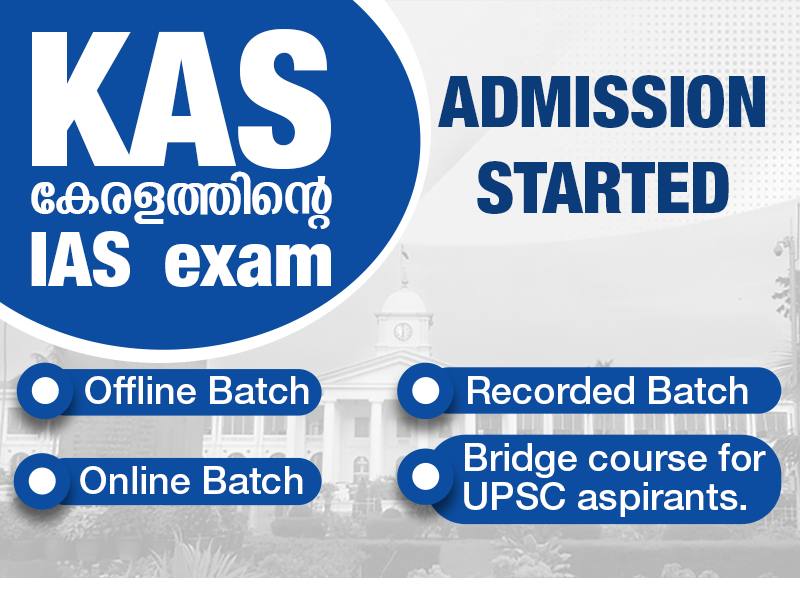

Best KAS Coaching in Kerala.Choose the batch type that aligns with your schedule and learning preferences.

Online & Offline Batches Available

-Admission-Started 1.jpg)

Online, Offline and Hybrid Mode

Youtube ലൂടെയാണ് ഞാൻ KAS mentor നെ പറ്റി അറിയുന്നത്. നല്ല motivationഅവിടെ നിന്ന് ലഭിച്ചു.KAS എഴുതുന്നവർക്ക് ഞാൻ KAS mentor recommendചെയ്യുന്നു.

Covid ഉം Lock down ഉം ആയി വേണ്ടവിധം പഠിക്കാൻ കഴിയാതെ ബുദ്ധിമുട്ടുന്ന സമയത്ത് ലഭിക്കാവുന്നതിൽ ഏറ്റവും Best class ആയിരുന്നു KAS mentor ഇൽ നിന്നു കിട്ടിയത്.Very thanks to KAS mentor.

Syllabus ന്റെ എല്ലാ Area യും KAS mentor cover ചെയ്യുന്നുണ്ടായിരുന്നു.അതുപോലെ അവർ Conduct ചെയ്യുന്ന exams ഉം എന്നെ വളരെ സഹായിച്ചു. KASmentor ന്റെ അധ്യാപനരീതി വളരെ sincere ആയിരുന്നു.

മറ്റുള്ള പല institutes ലും പഴയ material പുതിയ package വഴി തരുമ്പോൾ KAS mentor പുതിയ material with updated facts ആയിട്ടാണ് നൽകുന്നത്. അതെനിക്ക്വളരെ ഉപകരിച്ചു.